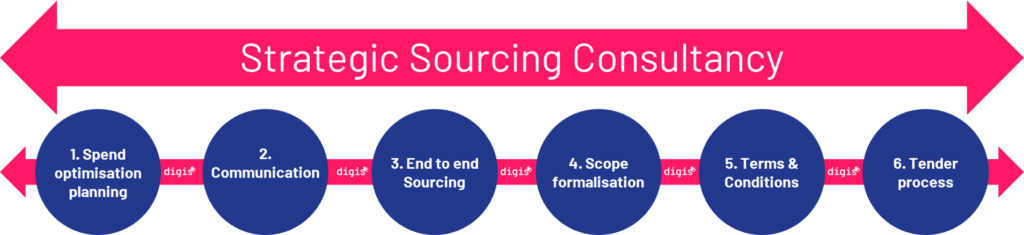

In this blog post, Ahmed AboulGheit, Head of Sourcing at Digis Squared, shares his insights into the Strategic Sourcing Consultancy we deliver. This capability is just part of the Consultancy work we undertake, and this blog provides an insight into how we help our clients bridge the gaps between service providers and new technologies, and enable smarter networks.

What is Strategic Sourcing Consultancy?

“An efficient and capable multi-purpose multi-tool in your toolkit!,” explains Ahmed.

The Strategic Sourcing Consultancy we deliver covers six key areas,

- Spend optimisation planning – using different scenarios to forecast and plan.

- Communication and alignment across departments and multiple operating businesses.

- End to end Sourcing process review and tuning.

- Scope formalisation, to ensure end-to-end coverage, and eliminate gaps in delivery and support.

- Terms and Conditions review and validation, ensuring appropriate vendor liability is defined and avoiding any risks to the client.

- Tender process validation and governance: everything from process definition to tender documentation writing and issuance, selection processes and assessments, regulatory obligations, and all aspects of governance.

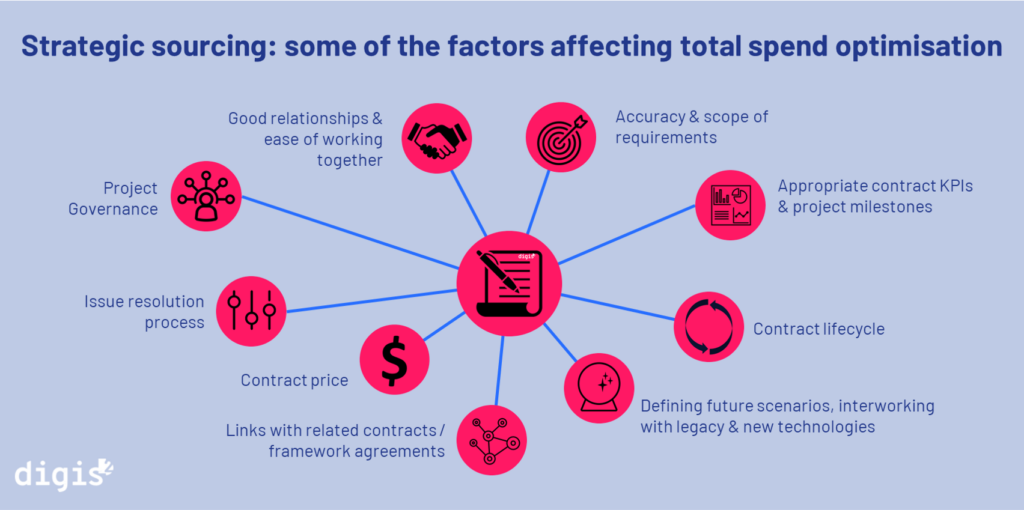

Total spend optimisation, it’s not all about direct price

You might be surprised to read that, but it’s true! Often, there are times when gaps in the contract reveal themselves partway through project delivery, meaning that extra budget needs to be granted for the project to be successfully completed. To mitigate this, your Sourcing Team need to have a deep understanding of the technical requirements, as well as their commercial implications and the contractual liabilities that have to be set on vendors. Achieving a good contracted price on the front page of the contract is often defined as success, but Strategic Sourcing looks at the optimisation of total spend, across the entire project lifecycle.

This blog focuses on scope formalisation, as that is a hot topic with many of our clients currently.

Scope formalisation

This subject is critical to ensuring robust, practical and well drafted contracts. No-one wants to work within a contract framework that is full of gaps, ambiguity and misunderstanding – relationships will quickly unravel, co-operation become strained, and ultimately customer experience will be impacted and extra budget needs will pop up. This is particularly true within telecoms infrastructure projects, where different generations of technologies from multiple vendors are sitting alongside each other, and technical interoperability problems are a normal part of the scope of all projects. Additionally, internal and external scope responsibilities intersect, and compromise and priorities need to be balanced.

To avoid this, scope formalisation plays a vital part of the development of the contract framework. Identifying the correct stakeholders and setting the project lifecycle helps manage expectations and boundaries. Defining the requirements with all stakeholders, while challenging them to ensure there are no gaps is vital to ensuring a successful project. Keep an open mind, be curious and explore ambiguity: what if this happens?, what about that situation? Revealing uncertainty in the scope, and clarifying or mitigating for it is an important component of scope formalisation.

Methodically classifying the scope into internal and external responsibilities helps reveal a clearer understanding of the stakeholders’ interests and priorities. The detailed work of translating their requirements into meaningful contractual conditions, while retaining clear engineering objectives is critical to scope formalisation. All of these elements are key aspects to consider and take care of, and the skill and expertise of Strategic Sourcing staff are vital to help you to best design and achieve them.

Scope formalisation requires a deep understanding of both Engineering and Contractual languages. Strategic Sourcing staff in the Telecom industry provide the vital role in understanding, challenging, clarifying and formalising the translation. A sound knowledge of Engineering language is needed to understand the end-to-end scenario from the technical guys in the team, and then translate it into contractual conditions that would make the vendors fully liable on the targeted scope with full protection to the client if not fulfilled.

Addressing unforeseen issues

Having done all of that work, we should also be realistic – we are usually dealing with new systems and technologies being integrated into unique and complex telecoms ecosystems. As the project progresses, there will be issues that even the best brains cannot imagine in advance! So how to solve this and ensure there are no gaps in delivery or support?

It is vital to define an issue resolution path from the beginning. Good Project Governance, alongside an issue resolution process, goes hand in hand with project KPIs and milestones, and helps ensure that the total cost of the project is managed. These pragmatic steps are a core part of scope formalisation, and together ensure that excellent working relationships are achieved throughout this project, so that the next project becomes even easier!

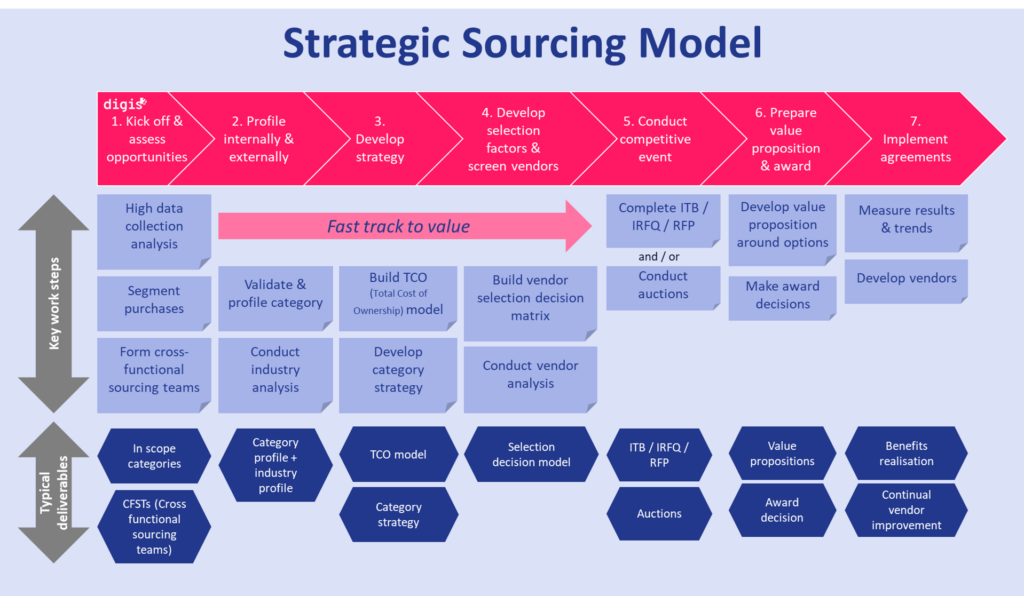

Strategic Sourcing Model

The total spend optimisation activity I’ve shared here is just a part of the work undertaken within Strategic Sourcing; the model below illustrates other typical components. However, this type of model is simply a starting point, as sourcing and vendor management should ideally be seen as an ongoing relationship, in which there are sometimes discrete projects and activities, which form a part of a bigger picture.

At Digis Squared, some of the work we undertake for clients helps to bridge the gaps which can arise when a project is defined too narrowly. In these situations, the rush to optimise a price can cause friction and misunderstanding within the project team; gaps in scope definition and project requirements can lead to project delays and increased costs further down the line. Our deep undertaking of multi-vendor systems and technologies, and our ability to understand both the technical and commercial language of contracts helps ensure that our clients avoid these gaps, or resolve them if we are brought in later.

Use our expertise to assist your team

The team here at Digis Squared have significant experience and expertise in strategic sourcing, vendor management and project commercial governance. Indeed, the executive team which founded the Digis Squared business almost 5 years ago, all felt passionately that addressing these gaps between vendors and network operators, was vital to ensuring improved customer experience and efficient business operations. I really enjoy being part of this team, and working with clients so that together we can optimise their contracts and processes.

AI enhancement of capacity management: what’s next?

Today, we use an open-loop control system to apply our AI methods. However, as predictive model accuracy improves, we anticipate transitioning to a fully automated Self-Organized Network (SON) – enabling closed-loop network management with self-planning, self-configuration, self-optimization, and self-healing – system in the near future.

In conversation with Ahmed AboulGheit, Head of Sourcing at Digis Squared.

Ahmed has worked in and led international procurement teams in the telecoms sector since 2005 working alongside major consultancy firms, within multidisciplinary, agile teams. At Digis Squared he manages our contracts, sourcing, partner management and pricing activities, and supports our teams with consultancy in this field.

If you or your team would like to discover more about our capabilities, please get in touch: use this link or email sales@DigisSquared.com .

Digis Squared, independent telecoms expertise.

Discover more

Image credit: Mohamed M